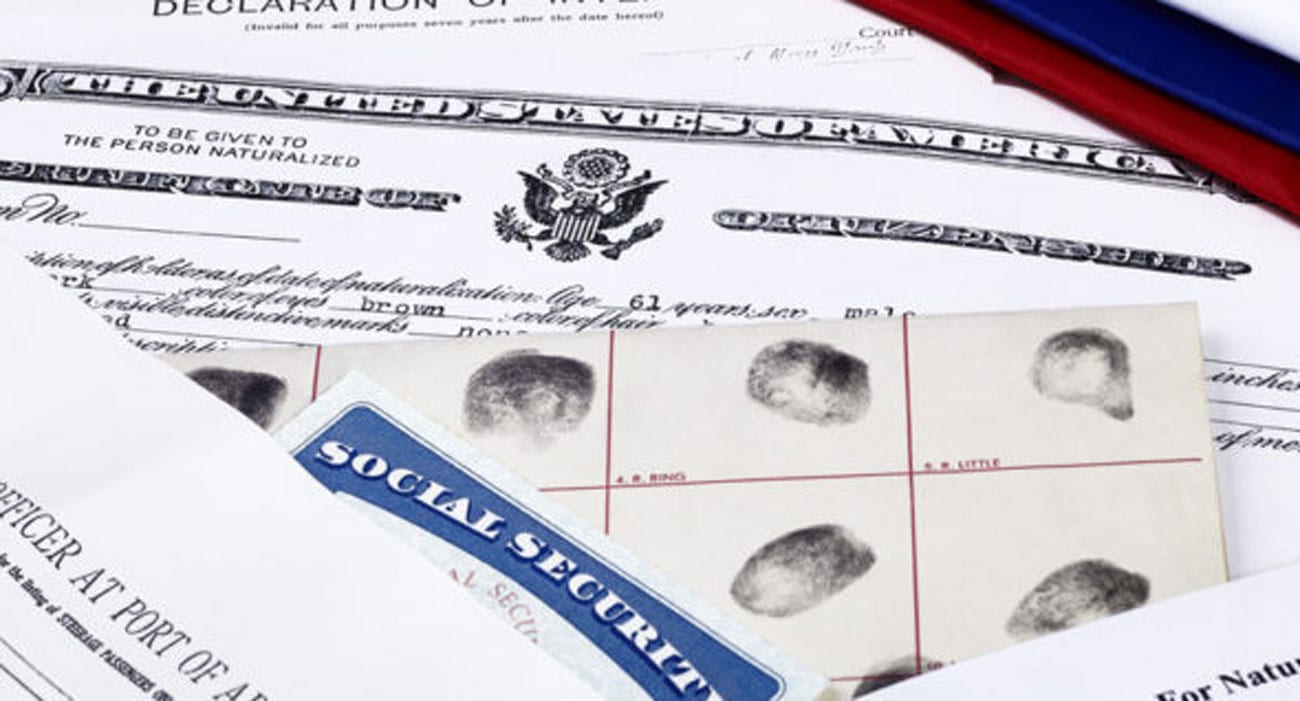

Documents you need to take

When packing your ‘Bug Out Bag’ you want to include important documents (or copies) just in case you need them after an emergency. For example, lets say that there is a high confidence forecast of a hurricane impact in your area and you have decided to leave. As you are putting ‘stuff’ in your vehicle, you realize that your home might be damaged to the point of losing it, and the things inside. Are there important documents that you should take with you?

If your home has been wiped out by disaster you could lose whatever was in it, including important papers and documents such as those which prove or verify personal information of your identity, credentials, holdings, insurances, and other important records. So it is very important to ask yourself, “What ‘important papers and documents’ might be important to take?”

The circumstances that lead you to evacuate will affect the choices that you may make, such as whether or not your house may still be standing when you return, or the likelihood or timing of when you might be able to return, the probable or expected damage, etc.. Today much of our so called ‘important papers and documents’ are held in electronic form. ‘What if’ their electronic storage is somehow damaged or unavailable? What if the means or method of reacquiring that electronic data becomes unavailable to you? Today we rely heavily upon digital information and very little upon ‘hard copy’ information. Should we keep ‘hard copy’ backups of certain documents and information? And should we take any of that with us? If you do, then it’s a good idea to keep them in a waterproof pouch or container.

The following list of documents may be useful while separated from your home during and after a disaster. In most cases, a photo copy of the original document may be all that you need. Other items you will already be carrying in your wallet. It would also be wise to place documents in a clear, sealed, plastic sleeve and store all the documents in a binder with an inventory list to keep it all organized. As a backup it is recommended to also place everything on flash drive, important documents, family photos, tax returns, etc.

HARD COPY OF IMPORTANT PAPERS AND DOCUMENTS

The following is a ‘brainstorm’ list of ideas, not all of which may be practical…

- Contact List (family, friends, doctors, banks, employers, insurances)

- Birth Certificate

- Drivers License

- Passport

- Try to have two forms of photo ID (drivers license + other?)

- Social Security Card

- Health Insurance Cards and/or Medicare, Medicaid

- Recent Bank Statement for each account (Checking, Savings, Stocks and Bonds, etc.)

- List of Credit Card Accounts (card numbers, expiration, and 3-digit code)

- Prescriptions for Medications, Eyeglasses

- Record of Fire & Flood Insurance Policies

- Property, Real Estate Deeds

- Vehicle Titles

- Vehicle Registration & Insurance

- Tax Returns

- Proof of Employment (paystub)

- Living Will or Advanced Healthcare Directive

- Death Certificates

- Marriage License

- Local and State Maps

- Family Photos on an external hard drive

- Pet Records – chip info and a photo of owner with pet, hopefully with some distinctive feature of pet

- Health/Immunization Records

Make sure that at least two of the above documents contain your current address (if you have a bug out location make sure you have two documents that show your right to occupy, your title to the bug-out property or a property tax notice, fire insurance policy, or recent mail addressed to you showing the bug out location) in case the authorities block the roads and only let current residents in.

Helpful Tips

- Keep a large photo of each family member in each bug out persons’ bag. In case you become separated and you need to query strangers if they have seen your loved one, a nice big photo will make life easier.

- Keep copies of all important documents in a waterproof case stored in a fire proof safe at a family members home. (This can be stored in the attic so that it doesn’t take up closet space.)

- No one wants to think about the worst, but it is wise to have defined and prepaid, when we “go” documents, and if something happens to you or your family, an extended family member should also have these documents.

- Incase of wildfire: Turn on every light inside and outside the home for the fire fighting crews/tankers to find it. If power goes out, is not a bad idea to have a 50 pack of glow sticks to place around the house so that aerial crews can spot your home.

For insurance reasons, it is recommended that you get as many photos as possible or better yet a video of the inside of your house for record. Open every closet and drawer and video everything, even the inside of the medicine cabinet and each shelve in the kitchen/deep pantry. The reasoning, there is absolutely no way to remember all the things you own if your home is destroyed by a hurricane, tornado, earthquake, fire or any other disasters.

When an insurance company does a rebuild they will only pay for what you can prove you own. Most people forget what they had and do not receive what they are due because the Insurance company will not payoff what you can’t show them in pictures or video proof.

The video will also show how your home is built and the furnishings helping the Contractor and Insurance companies to settle the amount owed to you. And honestly can anyone say for sure how many pair of socks you own or how much toilet paper you have stored? I will guarantee you if you tell an insurance adjuster you had 500 rolls of toilet paper, he will deny the claim if you can’t show him proof.

Just remember the Insurance Companies are your friends as long as you don’t file a claim and keep making your payments. After you file a claim they WILL be your worst nightmare.

If you have lots of jewelry or guns, most homeowners policies have a clause that states they will cover guns, furs, money & jewelry, but only up to $500.00 TOTAL not for each item. That is all combined value…please have those items appraised for their true value, so that you don’t get a $500 dollar check for $10,000 dollars worth of valuables. Place those appraisals in your binder with the insurance coverage.

One last thing, never, NEVER take a settlement before you talk with a reputable contractor and get a cost on every single item you lost; they will try to push you into a fast settlement.